Bump in delayed Social Security benefits after January

Published: 12/29/2023

Updated: 4/29/2023

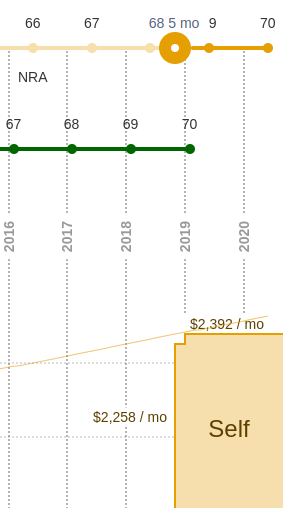

When using the ssa.tools calculator, you may have noticed a small notch or bump in the income chart when choosing a benefits start date later than the Normal Retirement Age. Here's an example of what this might look like for someone retiring at the age of 68 and 5 months. Initially, the recipient's benefit is $2,258 / mo but in the following January it jumps to $2,392 / mo:

If this is not a bug, what's going on?

When someone chooses to delay collecting social security past the Normal Retirement Age, they earn delayed credits that increase their benefit by 8% per year (0.67% per month) in exchange for waiting a little longer.

However, due to a little known quirk in the way the credits work, you only earn credits based on the months delayed in the previous calendar year.

In the example image above, the recipient began their benefit in November 2018, so intially the benefit was based only on months delayed in 2017. The additional 10 months of delayed credits were in 2018 and are not yet credited to the recipient. In Jan 2019, those credits kick in and the additional bump in benefits does as well.

There are a few cases where this bump does not appear:

- Early Benefit Reductions: This rule only affects credits from delaying after Normal Retirement age, it does not affect reductions from starting benefits early.

- Age 70: If the recipient starts the benefit at age 70, even if that is in the middle of the year, the full credits are applied.

- Spousal Benefits: Spousal benefits are not affected by delayed credits and so are unaffected by this rule.

This is not related to Cost of living adjustments (COLA). COLA is also applied in January, but in addition to this rule.

ssa.gov reference

ssa.gov has this to say about delayed credits:

If you retire before age 70, some of your delayed retirement credits will not be applied until the January after you start receiving benefits.

For example, if you reach your full retirement age (67) in June, you may plan to wait until your 69th birthday to start your retirement benefits. Your initial benefit amount will reflect delayed retirement credits earned from your full retirement age through the year before your 69th birthday. In January of the following calendar year, your benefit will increase for the credits earned in the year of your 69th birthday.